The economy has improved and you have two job offers. If these were your choices, how would you rather work?

The Old Way: 100% Discretionary 'Trust Me' Plan

Company A offers a market-competitive base salary but has a purely discretionary bonus plan. If the company makes money and the owner decides to share some of the profits, he or she will give you a bonus in the form of a “to be determined” award one year from now. There are no criteria, and the company certainly will not commit to a defined bonus amount. Just do a good job and hang in there.

The New Way: Structured Incentive Plan

Company B also offers a market-competitive base salary, but it’s in the minority 25 percent of contractors that offer a structured incentive plan. The company tells you that your target bonus opportunity is 15 percent of your base project management salary. The upside opportunity can be as much as 25 percent. There are three ways to earn your bonus: company performance, business unit performance and individual goals. You will receive three simple goals from your manager that will be easy to understand. However, these targets are “stretch goals” that are above your regular job duties. Your job is to complete projects on time and on budget. Extra cash is waiting for you if you can also increase margins over estimate and ensure customers are delighted. Which company would you choose? The company where the owner arbitrarily decides what you receive, or the one that presented you with a documented incentive plan tied to the business strategy that also shows you how to earn your bonus and how much it will be? There is a significant shift occurring in the engineering and construction (E&C) industry in how companies are paying bonuses to their employees. The trend is to move away from purely discretionary plans and toward structured incentive plans (with some discretion on individual performance measures). Owners need not disclose their actual profit numbers when using structured plans; communicating as a percentage to goal (e.g., company performance is at 105 percent to goal) is sufficient. Employees can look up performance on a pay table and identify their award percentage next to the achievement percentage.

Current Practice: Top-Down, Pool-Based Funding

You can’t blame company owners for their age-old pay practices. The majority of the industry is family-run or privately held. Owners like exerting control through entirely discretionary plans. Having no commitments or promises relieves stress, but it is becoming harder to recruit with “trust me” incentive plans. The modern and more competitive workforce demands a fair deal where they know the rules upfront and they know about the bonus opportunity before taking the job.

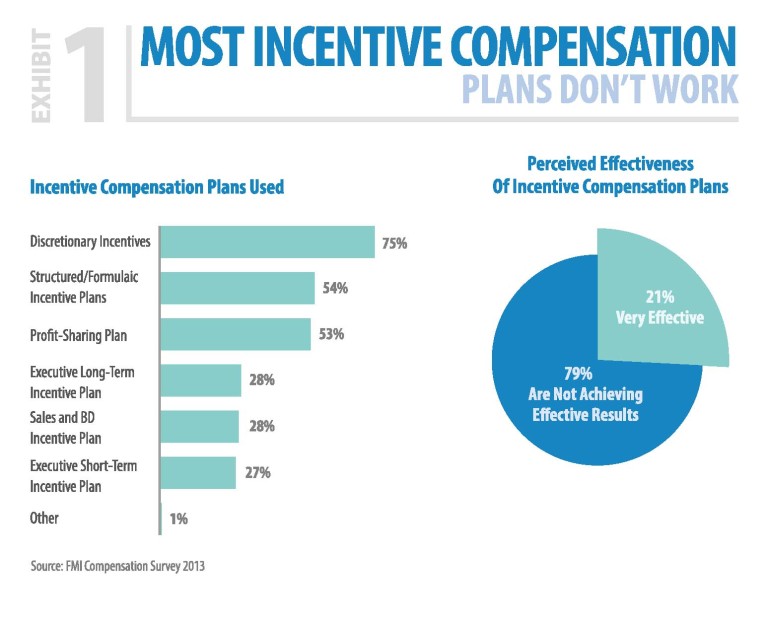

Figure 1

Figure 1Top-down funding approaches are prevalent in the construction industry. In fact, a recent FMI compensation survey found that 75 percent of contractors use top-down funding models for their incentive compensation plans (Figure 1). A top-down model allocates a portion of profits for incentives and then managers allocate the pool in a discretionary manner. The average budget for annual bonus programs is 15 percent of net profit before tax (Figure 2). Actual award amounts may not relate to employee expectations or labor market norms.

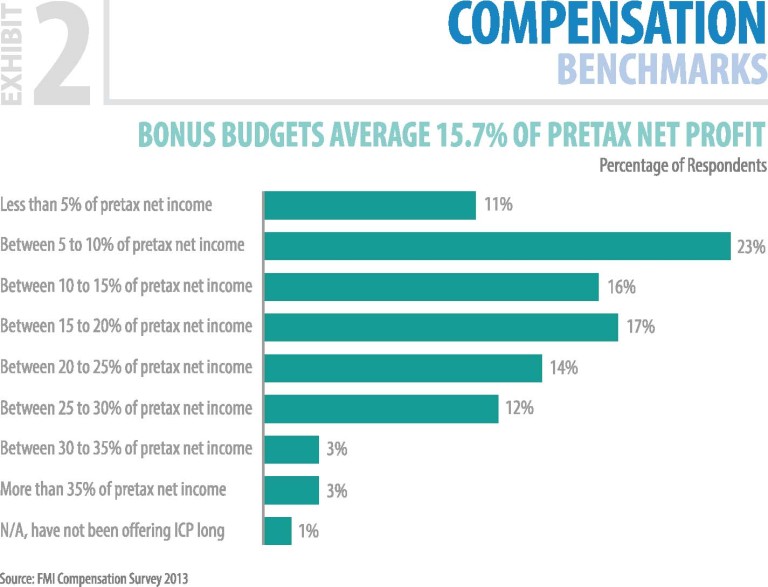

Figure 2

Figure 2The two key problems with top-down funding are:

- It is a function of headcount—The individual award amount depends on the size of the pool and the number of employees participating in the pool. Increasing headcount will reduce award amounts if the size of the pool does not increase.

- Pools tend to pay out regardless of performance—Perhaps a company has a $3 million net profit goal. Even if it only achieves $1 million, there is a pool formula that pays out a portion of any dollar earned (e.g., paying out 15 percent of $1 million).

The question is, how do you explain to an employee that the company made more profit and individual performance was stellar, but bonuses will be lower because the company hired 20 more people. An unintended consequence can occur when management chooses to limit hiring in order to maximize bonuses, even though the company needs more human resources to grow and handle the workload.

Bottom-Up Funding: Another Way

Bottom-up funding looks to the labor market to establish target incentives as a percentage of base salary. If project managers earn 15% of base salary on average, for example, then a $1 million payroll for 10 project managers should yield a budget of $150,000 for bonuses. Here are the key advantages to this type of funding:

- Bottom-up funding guarantees a given level of pay for a given level of performance. It moves away from “trust me” and moves toward a calculable outcome. Employee commitment increases when the company makes a commitment to its workforce.

- It is easier to recruit with a known target incentive and upside opportunity. Because recruiting is easier, it becomes an advantage over the competition when attracting star talent (vs. “trust me” plans).

- There is a written plan document. The plan document becomes a recruiting tool that contains the plan description, calculation examples and terms/conditions.

- Budgeting is more consistent. With known headcount and target incentives, CFOs can treat the incentive budget as a variable cost with a direct link to profitability.

How to Build a Bottom-Up Funding Methodology

When developing a bottom-up funding approach, these seven steps must be factored into the process:

- Determine owners’ return on equity requirement—Contractors take a lot of risk in this low-margin industry, and they demand a high return on their capital investment given the risks involved. The Risk Management Association publishes average returns on equity for different types of general and specialty subcontractors. Returns should be better than a Vanguard bond fund!

- Install a fail-safe—A significant weakness of pool-based funding is that it tends to pay regardless of achievement. Set a fail-safe, based on owner return on equity requirement. This is often 50 to 60 percent of the net profit goal for the year.

- Do your research—Use empirical labor market intelligence to establish target incentives for each position. Why guess? There are several industry sources for company-reported data on E&C jobs.

- Conduct a budget roll-up—Do the math. Ten project managers at 15 percent is a number. Five project engineers at 10 percent is a number. Add all of the target incentive budgets to derive an overall bonus budget.

- Model your cost—Model out expenditures for a typical year, a high-performing year and a low-performing year. Run a pro forma using last year’s results. What is the stress test or max payout allowed under the plan?

- Adjust target incentives to match affordability—After benchmarking and cost modeling, you may discover that market rates are out of your budget. Simply ratchet down target incentives until the budget meets your affordability requirements. You may also need to update your compensation philosophy to guide future pay decisions to a level that you eventually want to pay.

- Define the upside ratio—Set the upside or maximum opportunity under the bonus plan. Most plans have an upside of 150 percent of the target incentive. Therefore, if the target incentive were 10 percent, the upside would be 15 percent.

Get Ahead & Drain the Pool

The manufacturing, high-tech and health care industries have all used structured incentive plans for decades. The engineering and construction industries have not followed suit. There are very few public E&C companies, and a large portion of the industry’s privately held firms use top-down, pool-based funding bonus formulas. Bottom-up funding is another way to create a financially accountable plan that features definitive target incentives. Employees are more motivated to perform when they know how much they can earn and what the related requirements are. Bottom-up funding is also more financially accountable because it pays owners first, requires a minimum level of profit to fund the plan, and contains a fail-safe to prevent the plan from ever owing more in bonus payments than profits earned. Finally, bottom-up funding can mean the difference between success and failure in today’s competitive business environment. With economic conditions improving and an expanded number of job choices opening up for construction workers, the importance of developing structured compensation plans based on measurable criteria and centered on employee performance and development will only increase in the coming years.