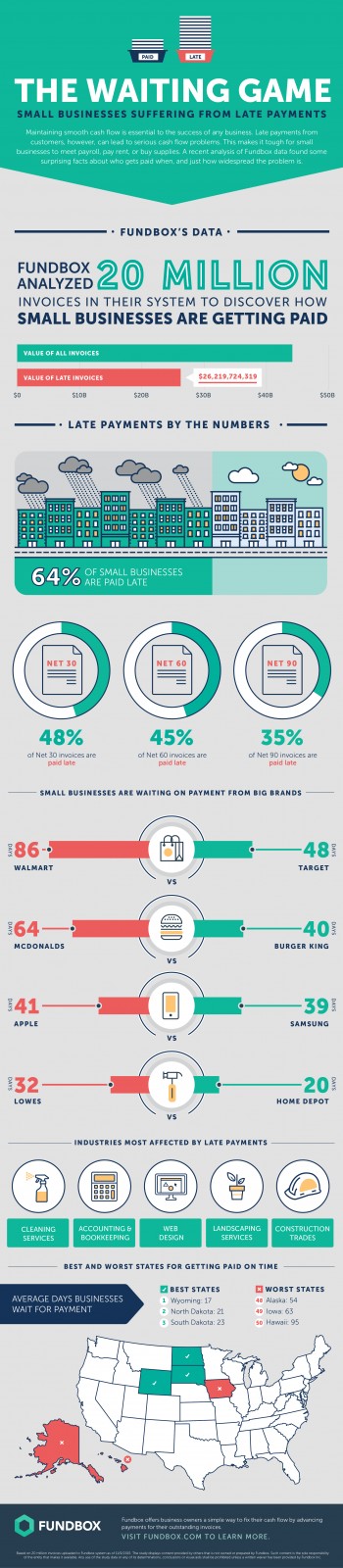

SAN FRANCISCO (November 19, 2015) - Fundbox recently released data findings on invoice payments from its platform. Based on data entered into the accounting and bookkeeping systems of tens of thousands of SMBs, the study revealed the widespread problem of late payments; 64 percent of small businesses are affected by late payments on open invoices. Additionally, the data showed that many large corporations take the longest to pay SMBs. According to a United States Bank study, 82 percent of small businesses fail due to poor cash flow management.

SAN FRANCISCO (November 19, 2015) - Fundbox recently released data findings on invoice payments from its platform. Based on data entered into the accounting and bookkeeping systems of tens of thousands of SMBs, the study revealed the widespread problem of late payments; 64 percent of small businesses are affected by late payments on open invoices. Additionally, the data showed that many large corporations take the longest to pay SMBs. According to a United States Bank study, 82 percent of small businesses fail due to poor cash flow management.

Fundbox's analysis highlights how net-terms and late payments contribute to poor cash flow: half of all net-30 invoices are paid late, while 45 percent of net-60 and 35 percent of net-90 terms are not paid on time. This creates a massive pain point for SMBs and underscores the market demand for technologies that help manage and optimize the billions of dollars tied up in outstanding invoices.

Corporations that take the longest to pay SMBs:

- Walmart – 86 days on average

- McDonalds – 64 days on average

- Target – 48 days on average

Industries most affected by late payments:

- Cleaning services

- Accounting and bookkeeping

- Web design

- Landscaping service

- Construction trades

U.S. states where businesses wait the longest to get paid:

- Hawaii – 95 days on average

- Iowa – 63 days on average

- Alaska – 54 days on average

U.S. states where businesses wait the shortest to get paid:

- Wyoming – 17 days on average

- North Dakota – 21 days on average

- South Dakota – 23 days on average

"The nature of B2B payments, and the common practice of net 30, 60, 90+ terms, puts incredible pressure on small businesses," said Jordan MacAvoy, vice president of marketing, Fundbox. "The problem is amplified in healthy, growing businesses where short-term expenses increase before additional income can be captured. Fundbox is laser-focused on making cash flow gaps for small businesses obsolete, and to date, our platform has improved the cash flow for tens of thousands of businesses."

For more information, visit Fundbox.