A strong market brings more customers, which often leaves business owners wondering if they should expand. Creating a strategy for entering a new market is a popular and attractive component of many business plans. Expansion is often an excellent growth engine, allowing a firm to grow, obtain and retain top talent, and position new talent in strategic roles. Satellite locations also offer contractors the opportunity to protect key accounts and customer relationships, and growing with customers helps maintain strong, lasting relationships. The challenge in creating a satellite location is the allure of the concept: It’s exciting to think about opening a new office or market, but the task itself often serves as the bright, shiny object that becomes a distraction when executed incorrectly. Many business owners consider expansion while sunken in excitement, forgetting the basics and neglecting the important conversations about controls and processes.

The Strategy

Business owners considering an opportunity like this should ask, “Why would the firm benefit from an expansion?” and “How does this expansion tie to the strategic vision?” Consider your company’s current market share and opportunity. If a commercial contractor has 5 percent of the market share, and there is boundless opportunity in the current geography, why go elsewhere and increase the business’s risk profile? A strategic business move should always be grounded in data that supports the concept.

The People

All companies should have a strong human-capital strategy. Growth (even if only a local expansion) requires talented team members. Building a strategy without the talent to support it is futile. Far too many expansion teams end up failing as a result of:

- Reluctance—The candidate sees this as their only option to grow with the company, so they begrudgingly accept their new assignment.

- Necessity—The candidate was not the first, second or third choice, but simply someone who was available.

- Misplacement—The candidate is great project manager but not necessarily on the path to ascension as a great leader.

- Unwillingness— The candidate isn’t willing to work nights and weekends to develop the grassroots campaign required to enter a new market.

- Misunderstanding—The candidate is a local sales rep unaware they need the aptitude to grow an office in addition to simply generating sales.

- Fear—The candidate fears they will not be allowed to return to work at the home base if they do not like the new location or their role there.

The Role of Corporate Services

There should be enough opportunity to necessitate a need for corporate services. However, a long-view should reference a business plan with triggers that show an understanding of all costs and ramifications for a successful operation. One consideration would be the role of accounting. In a start-up satellite operation, most, if not all, accounting would be done at the home office. However, there should be a volume or project total trigger that “activates” a local controller. Similarly, estimating might be offloaded to the home office, but it may be a strategic decision to leverage local resources. The critical aspect of this discussion centers on timing.

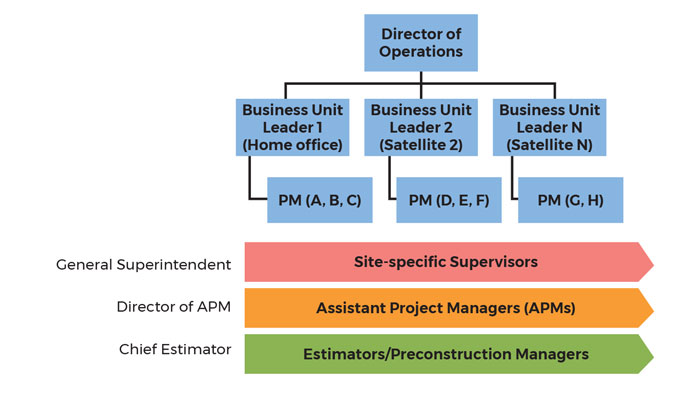

Figure 1 illustrates a matrix that examines the roles and connections to home office shared resources. This is meant to provide a business-modeling approach rather than a reactive, knee-jerk need for resources. Each of the decisions related to shared components comes down to strong, data-driven decisions, such as whether or not estimating will lie with the local office, overseen and supported by the home office once the company achieves a certain revenue target. If so, cost allocations can then be shared on a volume basis. For instance, if Satellite 1 contributes 25 percent of the volume, it would absorb 25 percent of the prorate share of the home office’s expenses. It is usually assumed that as offices or satellites absorb costs, they also become accountable for profit generation.

There are often distortions in financial analyses because companies fail to separate satellite costs and profits appropriately. For example, as projects are recognized based on their ties to customers, which may in fact be local, it can be easy to miscalculate true costs because they were job-costed. Early in the timeline, this is practical, but eventually, it will be important to ask, “Can this business unit support itself long term?” Satellites should be evaluated as franchises of the home brand. Many businesses leverage this growth tactic, but an equal number of businesses owners have failed their satellites because they missed these strategic checkpoints. Be sure to think of the satellite as a strong beacon of opportunity instead of being distracted by the bright possibility of expansion.