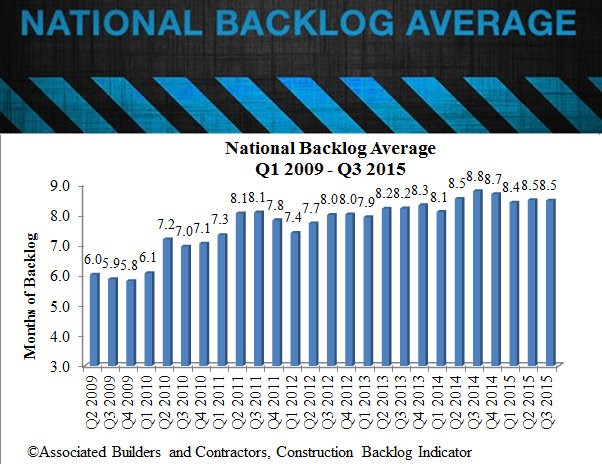

WASHINGTON (December 16, 2016) – The backlog of commercial and industrial construction projects reached 10.3 months in the South, the highest reading in the history of the Construction Backlog Indicator (CBI), according to third-quarter results announced today by Associated Builders and Contractors. Nationally CBI remained virtually unchanged at 8.5 for the quarter, although it has declined by 3.5 percent year-over-year, indicating that the nonresidential construction backlog has stabilized at a high level.

"Nonresidential construction remains one of the nation's leading engines of economic growth," said ABC Chief Economist Anirban Basu. "Industry spending is up 11 percent on a year-over-year basis, and the most recent backlog indicator strongly suggests that construction volumes will continue to recover. Unlike prior years, both the private and public sectors are now contributing to spending growth.

"While rapid economic growth continues to elude America, the economy has been strong enough to produce more than 2.6 million net new jobs over the past year," said Basu. "Wage growth is poised to accelerate and residential markets continue to improve, with single family activity picking up recently and home prices continuing to edge higher in many communities. This implies ongoing support for commercial construction and stable tax collections or better, which ultimately translates into more public works projects."

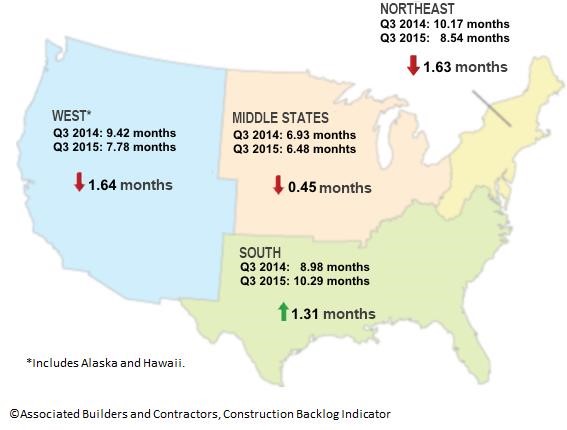

Regional Highlights

- The South continues to be associated with large-scale projects that help drive the construction backlog higher. After a lull in backlog growth, many Louisiana contractors are indicating a surge in backlog associated with industrial projects. Commercial activity in Florida continues to expand in virtually every major city.

- Despite a loss of momentum in energy-related investment, backlog in the Middle State continues to be supported by a host of other segments, including large-scale distribution centers, capital investment in automobile factories and significant levels of healthcare- and medical research-related investment, including in cities like Grand Rapids.

- The Northeast boasts the second highest CBI reading after the South, with public spending increasingly supporting activity in states like Maryland and Pennsylvania.

- Technology companies continue to expand their physical footprint and to generate profound levels of new wealth. As a result, backlog in the West has expanded briskly over the past two quarters and is now approaching eight months.

Year-Over-Year CBI Map of Regions and Backlog Months

Third Quarter 2014 v. Third Quarter 2015

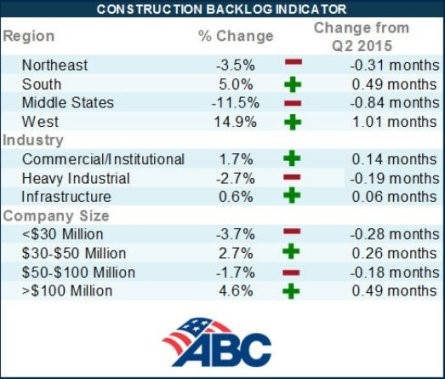

Industry Highlights

- For a second consecutive quarter, backlog in the heavy industrial category stood at more than seven months. Prior to the last two quarters, backlog had never been above seven months in the history of the CBI series.

- For a 13th consecutive quarter, backlog in the commercial/institutional category stood at more than eight months. Backlog in this category has not exceeded nine months during the history of the series.

- For a fifth consecutive quarter, infrastructure backlog stood above 9 months. It is likely that backlog will soon exceed the 10 month threshold.

Highlights by Company Size

- Firms of every size continue to be impacted and unnerved by skilled labor shortfalls. Without question, the lack of sufficient numbers of skilled craftsmen has helped to put a lid on CBI in recent quarters, with a growing proportion of firms turning away projects.

- With the outlook for public infrastructure spending improving, backlog in the larger firm categories is likely to expand during the quarters ahead. Large-scale infrastructure projects tend to have high levels of large firm participation.

- Over the past year, firms in the $30 million to $50 million annual revenue category have experienced the most improvement in average backlog. Six years ago, backlog among these firms stood at less than five months. It is now roughly double that at 9.9 months.

For more information, visit ABC.