With the start of 2023, the long-awaited new lease accounting standard implementation date has arrived for private companies. All private companies with annual reporting periods beginning after Dec. 15, 2022, should have adopted ASC 842 by now. The companies should have evaluated all their leases and recorded their 2022 year-end financial statements in accordance with the new standard.

Recap of ASC 842 Changes

The new leasing standard, ASC 842, replaces the previous leasing standard ASC 840. Under the old standard, accounting for leases required lessees to classify leases as either capital or operating.

Capital leases were recorded on the balance sheet, while operating leases were not recorded on the balance sheet. Instead, operating leases were disclosed on a footnote in the financial statements with total lease payments made for the reporting period and future minimum lease payments under the lease agreement.

The main purpose of the new lease standard is to record all leases — whether capital (which are now known as financing leases) or operating — on the balance sheet. The standard aims to make the “off‐balance-sheet” operating leases more visible, clarifying the entity’s leasing obligations on the financial statements instead of leaving them embedded in footnote disclosure.

Under the new standard, almost all leases must be shown on the balance sheet with a right-of-use asset and a liability. The purpose of the accounting changes is to make financial statements more legible for their users and to disclose an entity’s exposure to all risk and reflect its true financial position.

How Does This Change the Financial Statement?

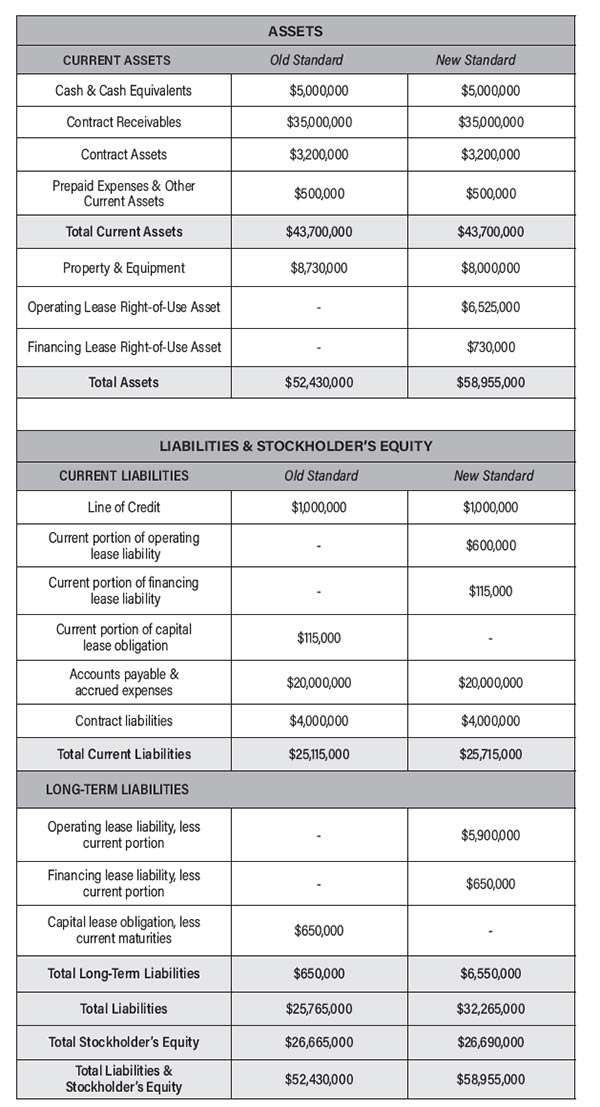

As previously mentioned, the main change on the financial statements is including a right-of-use asset and a liability for operating leases that were previously not shown on the balance sheet. Figure 2 is an example of the balance sheet of a company with a long-term office space building lease.

As can be seen in the example, the operating lease now appears on the balance sheet in alignment with the new standard, with the right-of-use asset and liability of $6,525,000 and $6,500,000, respectively, adding to the total assets and total liabilities.

The new standard not only affects the presentation of financial statements and related disclosures, but also has a significant impact on financial ratios and financial statement readers’ assessment of the company’s financial position.

The purpose of presenting financial statements to readers such as bankers and surety companies is to obtain financing and bonds; therefore, companies should evaluate the changes in the key financial ratios that result from the adoption of the new standard.

Impact on Key Financial Ratios

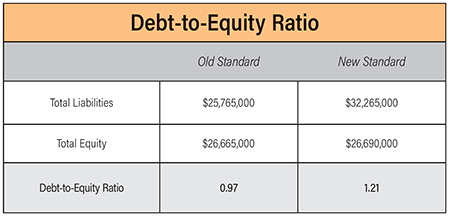

Debt to equity ratio

The debt-to-equity ratio is a leverage ratio that compares the total debt balance on a company’s balance sheet to the value of its total equity.

The ratio measures a company’s financial leverage and simply presents how much debt a company is using to finance its assets relative to the value of its equity. Under the old standard in Figure 1, the company had a debt-to-equity ratio of 0.97. This means that for every dollar in equity, the company had 97 cents in leverage.

However, with the new standard, the ratio increased significantly to 1.21. The new standard increases total liabilities

and results in an increase in the ratio for all companies.

Depending on the number of operating leases a company has, the impact on debt-to-equity could be larger than expected.

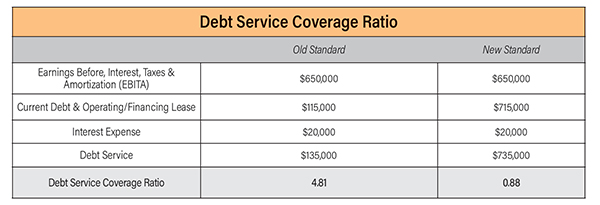

Debt service coverage ratio

The debt service coverage ratio is a measurement of a firm’s available cash flow to pay current debt obligations. As noted from the calculation in Figure 3, under the old standard it appeared that the company had generated enough money to pay their current debt obligation.

However, with the new standard, the ratio decreased to 0.88. This means the company no longer has sufficient cash flow to pay off the debts that must be paid within a year.

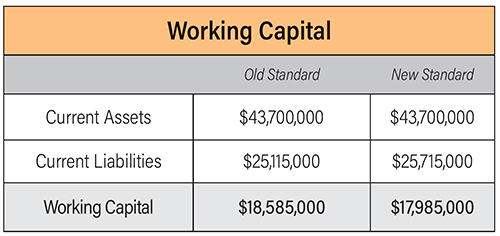

Working capital

Working capital is a financial metric that represents a business’s available operating liquidity: the difference between a company’s current assets and its current liabilities.

Figure 4 shows positive working capital under both standards, which is good, but the new standard lowered the amount of working capital by $600,000. Working capital is one of the key ratios that is evaluated to determine a contractor’s bond limit. The lower amount resulting from the new standard could lower the company’s bond limit.

As we can see from these examples, the three key ratios were adversely impacted by adopting the new standard. Heavy contractors who lease equipment and contractors who lease long-term real estate could be most at risk.

It’s Not Too Late

The first year after any significant accounting change is difficult. You may be well prepared and still encounter unexpected situations.

If you have significant operating leases that were presented off-balance-sheet in previous years, you most likely saw significant impacts on the key ratios mentioned above.

If you have communicated about this with your certified public accountant (CPA), surety bond broker and bankers — great job being on top of it.

However, if you haven’t yet, it’s time to alert all parties to the potential impact so that you can discuss strategies to minimize the impact on your lending situation and surety bond program. Most surety and bank underwriters are aware of and prepared for this new standard.

Communication is key for the first year. Discuss your plans for how the company will handle its lease obligations in the future, find the best structure, renegotiate leases, considering purchase, etc. It’s time to plan for the future that would be most beneficial moving forward.