To build a profitable construction business, owners must be focused on key performance indicators (KPIs) and bottom-line numbers. These KPIs are centered on sales revenue, overhead, profit markup, labor costs per unit of work, and your updated job cost labor for every project. You can’t expect anyone to care about your finances as much as you do. Someone else can pay your bills, send out the invoices, prepare financial reports and do the accounting, but the owner must be responsible for knowing and monitoring the numbers every day, week and month.

Profit is your return for business ownership, taking risk and investing capital in your business. Profit is the net amount remaining and available at the end of the year or month to provide a dividend or distribution to the company owners — or leave in the company for next year’s growth. Net profit is the best indicator of the success of your company’s strategic plan, leadership effectiveness, project managers, supervisors, and both your written systems and financial tracking systems.

Profit-focused leaders are competitive. They need targets and scoreboards to keep track of the score. You can’t reach your business goals by trying to work as hard or as fast as possible without knowing how well you’re doing financially. What aim do you take for your company’s financial, profit, job cost, labor and equipment targets? You must set these targets with your management team and formalize your annual financial plan every year. Determine your annual projected overhead expenses, the average overhead and profit markup you can make in your market, and how much gross and net profit you want to make.

Consider the following six financial numbers every owner needs to know, track and review regularly.

1. Financials, Profit/Loss & Income Statement

Based on my survey of over 2,500 construction companies, only 25% of company owners know or regularly track their annual sales volume, overhead or profit goals. Do you? Are you hitting your sales and profit goals, or do you even know your targets for the year?

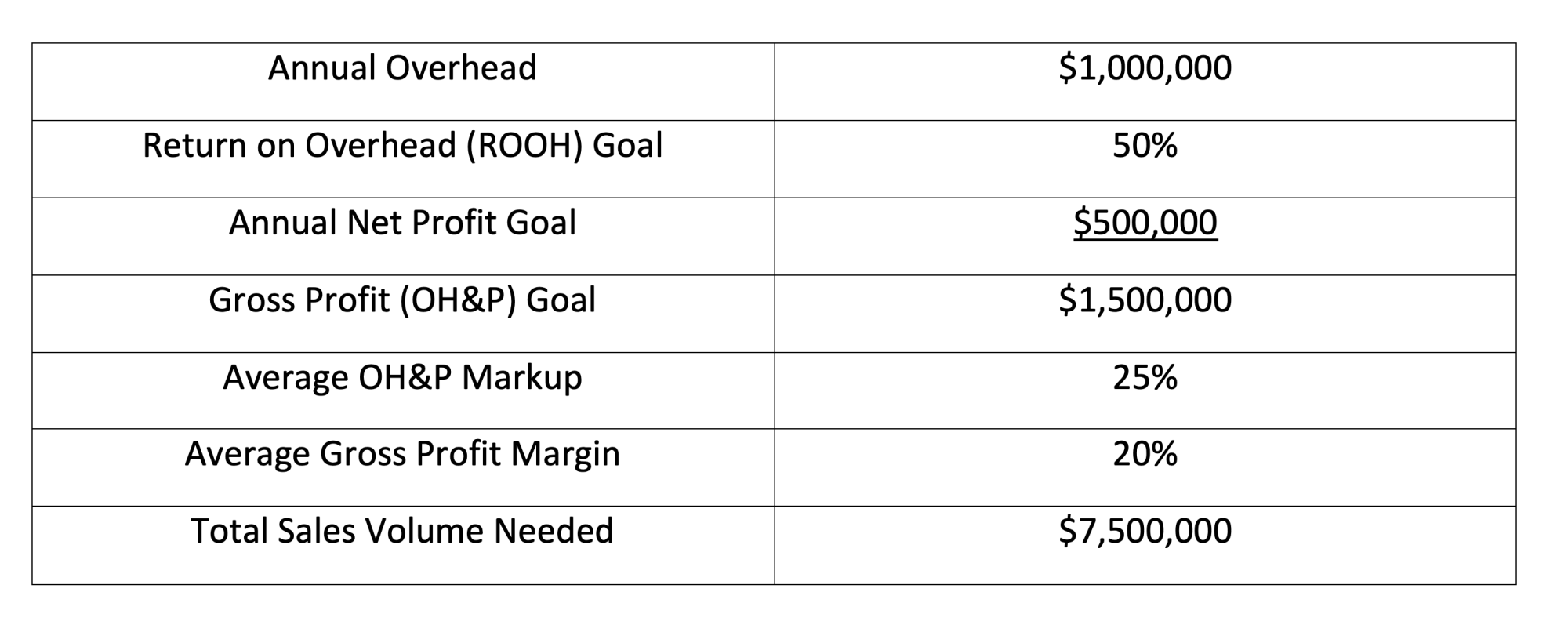

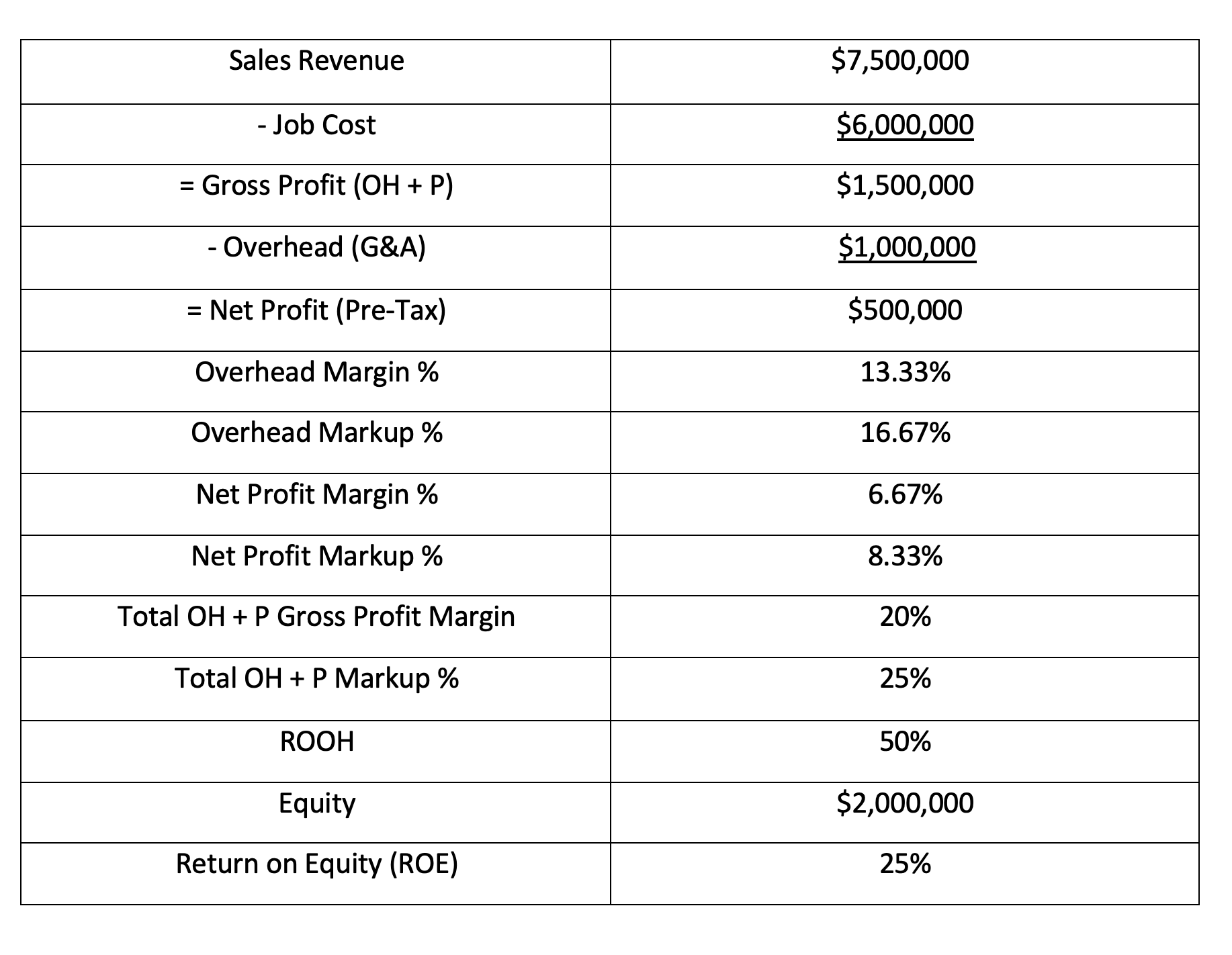

You must know the volume of total sales you need (at an attainable markup rate) to achieve your net profit goal. Track your sales and gross profit numbers monthly to make sure you are on target to hit your annual sales, overhead and net profit goals. Contractors who keep track are able to make necessary adjustments to their estimating and bidding strategy, customer and project bid selections, project management and field production as the need arises. To make a return on investment, you must know how much money you need to make to cover your indirect fixed cost of doing business or overhead. Calculate your annual overhead expenses you anticipate spending to operate your company. Then track it every month to make sure your actual expenses do not exceed your budget. The average contractor should make a net profit of at least 50% return on overhead. For example, $1,000,000 annual overhead should deliver a minimum net profit of $500,000.

Every year, meet with your management team and decide how much gross and net profit you want to make in actual dollars, not percentages. To determine the specific profit number you want to hit, and look at your projected overhead for the year. Then look at the risk you take to operate your business and decide how much net profit you want to make based on the return you want to make.

2. Job Costs

Before you can bid projects, you have to know exactly what it will cost to build. In addition, not knowing accurate labor and equipment costs creates inaccurate bids or estimates for the most important part of any job: labor. Most contractors don’t really know what their equipment costs annually or how much they should charge per hour when it is used on the job. For example, some contractors think their pickup truck costs around $750 per month to operate, but it actually costs over $2,900 per month.

Meet with your accounting manager to get an accurate actual cost for every employee and piece of equipment you own. For labor, include all taxes, insurance, workers’ compensation, vacation, union dues, overtime, small tools, training, pension, profit sharing and other benefits. The total employee labor burden rate can vary from 35% to as high as 90%, depending on where your company is located and which benefits you provide. For equipment, include the purchase cost, depreciation, finance and interest, payments, insurance, maintenance, tires, gas, GPS and repairs.

You must utilize an integrated accounting system and software to track your actual job costs weekly, either by cost code or task. You must create accurate weekly scorecard reports of each job’s labor and equipment costs versus the budget based on work completed. This will allow you to monitor the score and keep projects on budget every week. From these actual production results, you can verify the labor and equipment hours required to complete work on jobs you are estimating. If you don’t know what it truly costs to build a project, it’s next to impossible to make money pricing projects with guesstimates not based on actual production costs of completed projects.

3. Contract

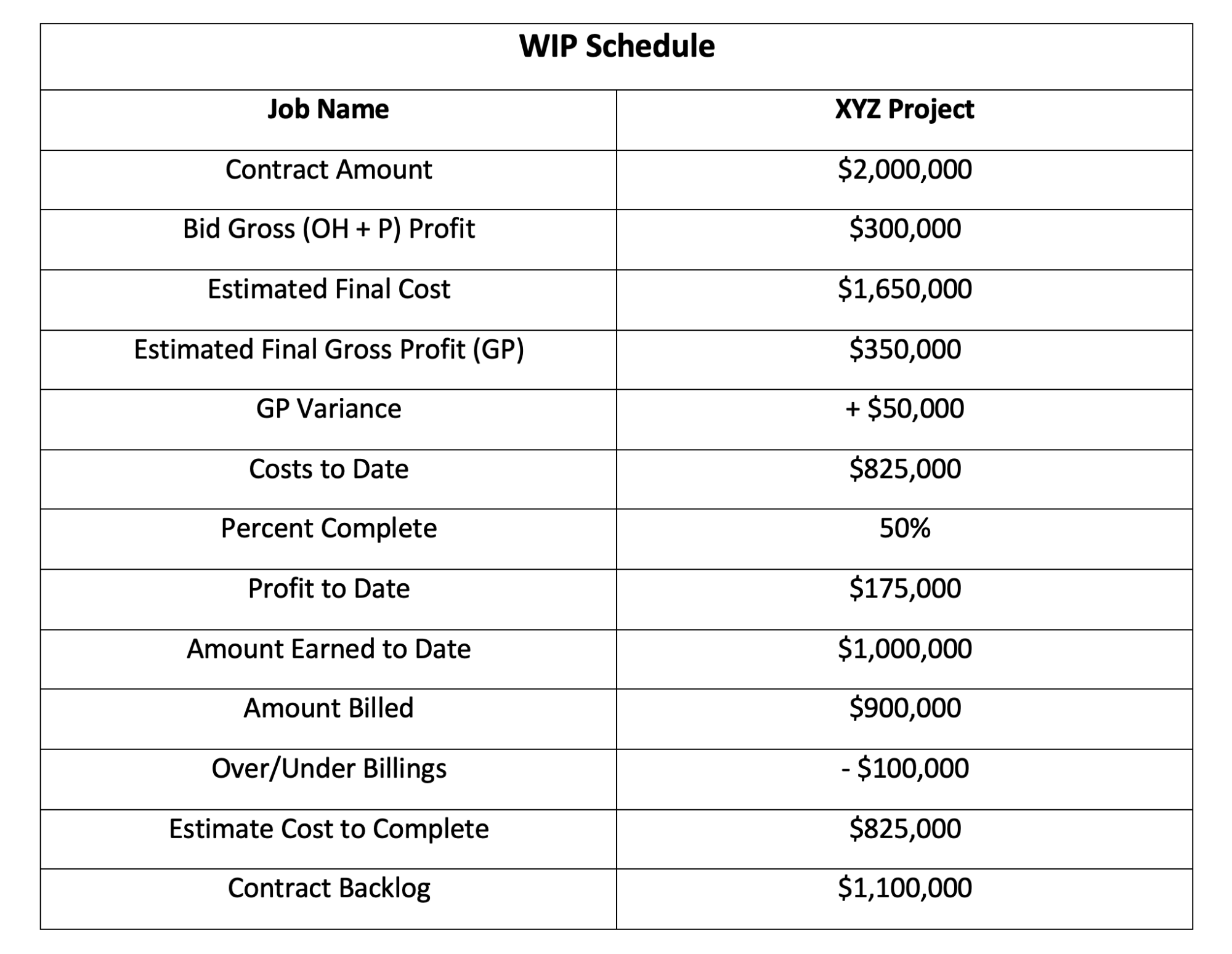

Top construction business owners know their construction contract numbers, including completed and current jobs in progress. Tracking reports will show how well you’re doing on current jobs and how you did on past jobs. Complete a work-in-progress (WIP) schedule every month listing out all current and completed projects and their costs.

4. Accounts Receivable

You can’t make money unless you collect what you’re owed. I know calling customers and asking for money isn’t your favorite job. Stay focused on collecting what’s owed by getting a weekly accounts receivable aging report to review all your outstanding invoices and due dates.

5. Liability

To keep your eye on the ball, you have to know your outstanding liabilities and debt. Create a report listing all your debts, liabilities and balloon or one-time payments due in the future. Make sure to include line of credit, line of credit drawn, other credit loans, equipment loans, future tax payments, real estate loans, total liabilities and bonding capacity.

6. Cash

Cash is king and the lifeblood of your business. To make better decisions, review a report of your cash position every week and include the following: cash in bank (checking, payroll account and savings), weekly payroll cost, weekly equipment cost, weekly overhead costs, investments, annual revenue per employee, annual gross profit per employee, and annual net profit per employee.

Aim at Nothing & Hit It Every Time

I’ve said it before, but most companies shoot at moving targets by attempting to make “as much money as possible” or “more than they are currently making.” But those are not clear targets. Do you have specific financial targets to shoot for, and do you track your progress monthly? Take at least one hour per week to review these financial figures with your key management team and accounting manager. This small investment of time will give you a valuable return.