Trade partners come in all shapes and sizes. For many contractors, greatness is simply based on how they perform on bid day. In competitive market situations, it becomes all about how low you can go. Unfortunately, there is a huge disconnect from this bid day dance routine and the actual performance in the field. It is this conundrum that creates internal friction as well.

Those same trade partners always seem to pop up on bid lists—much to the chagrin of the operations teams. In fact, many managers and superintendents feel as if their blacklist becomes the estimator’s go-to list. With the risk of piling on the estimators, there is probably also a sizeable disconnect in the feedback loop that the teams use to gather true performance data. It’s important to note that the phrase “They stink!” does not constitute actionable and objective data.

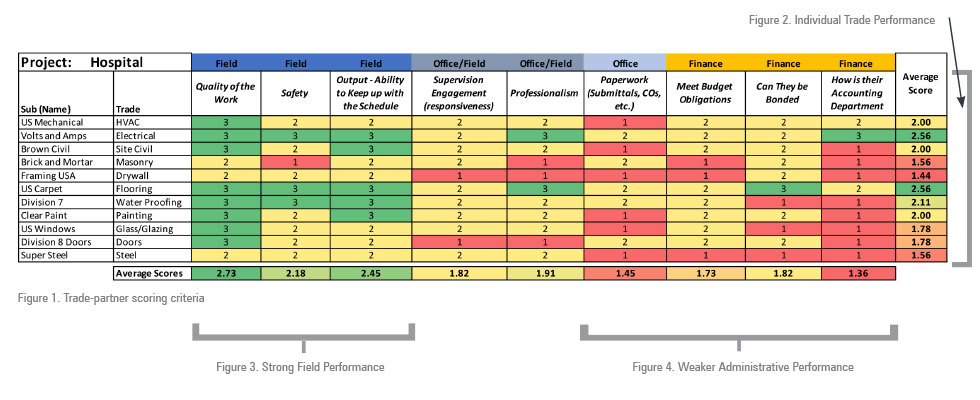

Figure 1 is an example of a trade-partner scoring criteria that is captured at the conclusion of a project. The grading scale on this sample is one to four, with four being the highest. It is important to note the different columns that constitute the grading scale. The first three (in dark blue focus) strictly on field performance. The gray columns would be a combined office and field perspective. The light blue columns would probably be the manager’s feedback while the yellow columns come from the finance office.

With a strong definition around what constitutes low and high scores, the firm can gather critical performance data on an entire project’s body of trade partners from a cross section of the firm. It is important to establish a strict grading criterion to avoid biases. Even with the best of intentions, a poor performer can be graded more harshly. For instance, a roofing subcontractor who meets the schedule requirements—but becomes a nightmare in the pay application process—should be graded appropriately. Put another way, if a trade partner scores well technically but fails in artistic impression, grade them accordingly.

The immediate benefit of this grading process is the rich feedback it can provide about an entire population of trade partners. There should be some strata to provide definitive actions that will drive a particular behavior. For instance, if grades of 2.0 and above define superior performance on one project, then what does a score below 2.0 mean?

What constitutes a change in direction or even being blacklisted? It is important to look at this as a rolling average. Everybody has a bad day at some point. In the case of Framing USA shown in Figure 2, what if its previous average score was a 3.0? The result of this one-time poor performance may simply be a phone call from the prime contractor’s office to provide this feedback. It is also important to note that while the average score in the example used here was a 1.44, the performance was largely impacted by that firm’s challenges related to paperwork and finance.

Another phenomenon that occurs in the world of trade contractor management is when a subcontractor or supplier performs well, their services become more in demand. It is important to always look at a subcontractor’s workload in totality and avoid taxing resources. Additionally, there should be some internal escalation plan to deal with repeat offenders. For instance, if this is Framing USA’s fifth project and also the fifth in a long line of unmitigated disasters, there should be concrete steps to not only provide this meaningful feedback to Framing USA’s management team, but also a rational explanation for that particular firm making it to that list of undesirables.

A second examination of this same project scorecard shares another piece of evidence (shown in Figures 3 and 4). While looking across at the average scores provided critical feedback on those individual subcontractors, looking at the column averages illustrates another telling trend. For the most part, the average scores in the field, office and finance followed consistent logic—while the participating trade partners performed adequately in the field, there were issues surrounding their paperwork and financial acumen. What does this say about the process within the firm?

This is not to say that the firm should adopt a stance devoid of control, but rather, has it actively engaged with its trade partners effectively to educate them on pay application processes, bonding, lien waivers/releases, etc.? It is important to note that one trade contractor may work with many general contractors or prime contractors in a year’s time, and each of their customers may have multiple processes. Does this scorecard speak more about your firm’s internal machinations rather than the individual trade contractor performance? What is it telling you?

Scorecards such as this are hardly new. Consistent application of not only a grading scale and a track record of performance require discipline. Often, feedback about suppliers and trade partners is limited to one-off data points or conjecture. Consider some of the biases that occur—a project manager hears from a superintendent that a subcontractor is weak. Like the telephone game of lore, that project manager tells an estimator and that estimator tells another estimator. Before long, that trade partner is deemed unworthy and roasted, without the benefit of a fair trial.