In early 2010, the surety industry finds itself feeling like coastal residents in the Southeastern United States do when monitoring a Category 5 hurricane in the Atlantic Ocean.

So far, other than some brief thunderstorms, the weather has been relatively calm. But there is a lot of trepidation about where the storm will hit. Will it still be a Category 5 or reduced to a tropical storm when it reaches land, and if so, how long it will last and how much damage it will cause?

The Eye of the Storm

According to Associated General Contractors (AGC) of America's economist, Ken Simonson, the macroeconomic outlook for the non-residential construction industry is not encouraging. There will be some bright spots generated by either public spending or private investment that is driven by demographics, such as healthcare, or policy, such as energy.

But there will be heavy competitive pressure for the available work, due to sharp declines in other segments.

According to Simonson, the primary economic influences that are fueling the impending storm are:

- The municipal bond market is now working, but bank lending has not returned. Banks have primarily used the bailout funding to shore up capital, instead of lending purposes.

Regulators are heavily scrutinizing loan portfolios and forcing reserve increases.

Lenders are requiring upwards of 40 percent equity from the owner, before they will finance a project.

- Vacancy rates for offices, retail and hotels continue to rise.

- Cash flow for new properties is not adequate, on a pro forma basis, at the new vacancy rate levels.

- Developers and owners are unable to attract investors or lenders.

- Banks are re-underwriting existing construction loans.

If the cash flow is no longer satisfactory for the property in the revised pro forma, the bank is requiring an additional equity injection from the owner or is pulling the loan.

- Tax revenue short falls at the state and local government levels will drive deeper spending cuts.

- Significant portion of the stimulus funding has gone to balance budgets, instead of construction spending.

- No job growth-the unemployment rate reached 9.5 percent in September, up from 6 percent a year ago. Without job growth, consumer spending will not grow, which will continue to put pressure on retail spending and tax revenues.

As a result, private non-residential construction declined by 10 percent in 2009. Retail, office and hotel renumeration will suffer far deeper cuts, ranging from 25 to 45 percent. Residential spending will decline by 27 percent. Public construction spending will post a 3 percent increase in 2009, as roughly $20 billion of stimulus funded highway projects will impact the 2009 figures.

In spite of the stimulus funding that will boost public construction activity, non-residential construction spending is expected to decline another 5 percent in 2010. Residential construction is actually expected to increase by 5 percent in 2010, due to a rebound in single-family housing. McGraw-Hill Construction is projecting an 11 percent increase in total construction starts in 2010, as they predict a 30 percent increase in single-family units. Multi-family construction will continue to decline, as a result of financing issues and over supply caused by unsold homes entering the rental market.

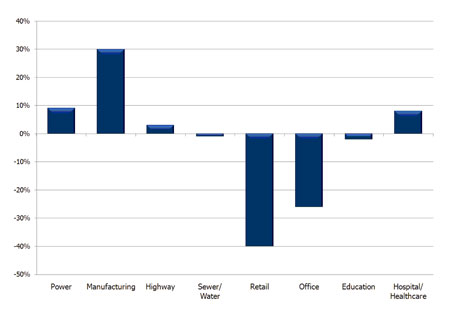

| Table 1: Expected Change in Construction Spending, 2009 |

| Power is expected to show a 9 percent increase in 2009 and continue at about that same pace in 2010. This is mostly driven by retrofitting current plants to produce cleaner energy, wind farm development and transmission lines. |

| Manufacturing will actually show a 30 percent increase in 2009, as companies close facilities and consolidate plants. This will drive some "onetime" expenditures, so this market will likely decline by 5 to 10 percent in 2010. |

| Highway spending will be up 3 percent over 2008 and likely up another 3 percent in 2010. |

| Sewer/Water is actually expected to show a 1 percent decline in 2009, due to regulatory hold ups and the Buy American Act. However, this market should post at least a 5 percent increase in 2010 as the stimulus money cuts loose. |

| Retail will be down 40 to 45 percent in 2009, but seems to be flattening out. If single-family housing improves in 2010, it should begin pulling the retail sector back up in late 2010 and 2011. |

| Office segment is off 26 percent in 2009 and not likely to improve any time soon. |

| Education sector is likely to dip slightly for 2009 and will not improve in 2010. Reduced property values will cut down district funding, poor economy will make bond issues difficult to pass and higher education is facing budget issues and decreased donations. |

| Hospital/Healthcare will be up 8 percent in 2009 and should continue to grow at the same pace in 2010. Uncertainty created by healthcare reform may slow spending temporarily, which will cause pent up demand. |

| Residential spending is expected to increase by 5 to 10 percent in 2010, but will be completely driven by single-family construction. Multi-family will continue to decline due to financing issues, increased supply from unsold homes and unemployment |

Fiscal results for 2009 will be very mixed for construction companies. Profitability will depend on how much 2008 work they carried into 2009, which market segments they serve and where they operate. Surety industry results did reflect a sharp increase in the loss ratio during the second quarter. The isolated thunderstorms have either been caused by project financing issues that caused cash flow problems for the contractor or occurred in regions of the country hit hardest by the economic crisis, such as Michigan.

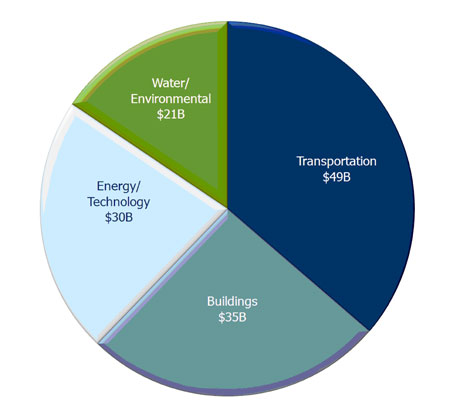

| Table 2: Stimulus Funding for Construction, 2009-2011 |

|

$49 billion-Transportation

|

|

$35 billion-Buildings $7 billion for DoD

|

|

$30 billion-Energy/Technology Clean energy retrofits

|

| $21 billion-Water/Environment |

2009 Growth or Loss in Construction by Industry

Companies who are tied to the building sector are generally feeling the impact of the sharp drop in spending on their backlog levels right now. This sector faces the biggest challenges, as contractors struggle to maintain backlog by compromising margins and assuming more risk. They also have more exposure to distressed project financing on jobs in progress, which could interrupt cash flow in the future.

On the other hand, contractors in the highway and infrastructure industry have generally been able to sustain or even grow backlog levels. Unfortunately, margins have not improved, due to increased competition from firms that historically concentrated on private infrastructure projects moving into state and municipal work. Also, companies will likely push to build backlog in 2010 and early 2011 while the work is available, given the uncertainty for this segment beyond mid-2011.

The combination of reduced construction spending, margin pressure, acceptance of more risk and liquidity issues provides the catalyst for a "shake out" of contractors who lack financial resources to survive or lack the management leadership to assess risk and implement the necessary adjustments. The length and severity of these economic conditions will be a significant factor in determining if the surety industry encounters a Category 5 hurricane or a milder tropical storm.

Stimulus Funding by Construction Type

Tidal Surge Protection

Tidal surge protection for both the construction and surety industries is being provided by the $787 billion stimulus package, which includes $135 billion for construction spending. While the stimulus package may not stop the storm from reaching land, it should provide a barrier to hold back catastrophic flooding, which gives the surety industry the confidence to ride out the storm.

To date, about $20 billion of funds have been used for highways, but very little of the building-oriented funds have been awarded. The vast majority of stimulus funding will be awarded by mid-2011, so any improvement in construction spending after 2010 will need to come from the private sector, increased state and local spending or another federal stimulus package.

If the broader economy does not start to respond to the federal spending by the second half of 2010, 2011 will likely see more reductions to construction spending. Even if there is a rebound in 2011, it will not improve fiscal results for most contractors until 2012.

The results will be mixed, depending on market segments.

Riding Out the Storm

Earlier this decade, the surety industry was hit hard by contractor defaults, which caused the industry to be extremely unprofitable. A significant cause of the last debacle was lack of underwriting discipline and over extension of surety credit, creating extreme difficulty for sureties to manage their way through the cycle without incurring substantial losses. By comparison, the industry was hit by a tsunami, instead of a hurricane. There was minimal advance warning, the industry was unprepared and no tidal surge protection was in place. The consequences were catastrophic.

Given this recent history, it would be understandable if surety companies started evacuating in a state of panic. Fortunately, that is not the case. While there is concern about the underlying fundamentals of the construction economy and the impact it will have on their profitability, surety executives are confident that they have the ability to avoid the catastrophic losses suffered during the last downturn.

Their confidence is founded on solid principles. In addition to advance warning, most sureties have improved their risk management methods and business models. Some examples include:

- Implementation of actuarial-based credit models

- Provides underwriters with a much better quantitative tool

- Effectively setting policies and managing their portfolio of accounts

- Emphasis on contractual risk analysis and transfer

- Focus on profitability, not market share growth

- More disciplined underwriting

- Sticking to proven fundamentals

- Focus on a "weeding out" process over the past twelve to eighteen months in preparation for this storm

By enhancing their quantitative capabilities (financial benchmarking and performance indicators), sureties have enabled their underwriters to focus more attention on the qualitative characteristics of each contractor. Their priority will be to evaluate each client's management capabilities and business model to reach a comfort level with the qualitative aspects of an account to validate their quantitative analysis.

The market realities for contractors will ultimately affect the sureties. The reality of the economy for the next eighteen months is that wrong decisions will be exponentially more damaging to contractors' results and their ability to survive than during moderate or hot economic climates. It is much harder to recover from a bad decision when the availability of work and margin are not sufficient to soften the impact.

Consequently, a surety's results are going to be more heavily tied to the ability of their clients to avoid bad decisions than the underwriter's ability to make good financial underwriting decisions. Contractors should anticipate and embrace more interaction and collaboration with their surety partners. Surety underwriters will rely on more objective information to evaluate their clients' ability to assess and manage risk, avoid bad decisions and make necessary adjustments before it is too late.

Accordingly, we recommend the following actions to instill confidence and proactively manage your surety relationship:

Communicate Openly, Honestly and Regularly

- Provide your business/strategic plan

- Decide how will you adjust to the market

- Provide microeconomic view-how does your situation differ from the big picture?

- Emphasize experience and capabilities of executive, project and financial management staff

- Collaborate about potential new business initiatives

- Consider geographic expansion

- Discuss different project delivery methods

- Consider changing scope of work or type of owner

How are you going to manage increased risk?

- Getting paid

- Subcontractor default

- Banking environment

- Tighter margins

Enable "Forward Looking" Analysis

- Provide substantiated projections of profitability and backlog

- Manage expectations-discuss what actions you will take in the future based on actual results vs. projections

- Have an A, B and C plan

- Establish communication plan with surety partners

- Decide what information would be most beneficial for you and the surety

- Establish frequency of information and meetings

Understand the Surety's Quantitative Analysis

- Review analysis to make sure everyone is on the same page

- Compare to peers

- Decide which ratios or performance indicators negatively impact your credit score

Address Bank Debt

- Service or reduce your debt load

- Backlog and profitability projections vs. covenants

- Cash flow projections vs. covenants

- Planned capital divestitures or expenditures

- Financial condition of your lending institution

Sureties realize that well-managed construction companies will survive this storm. They will emerge stronger and better positioned to capitalize on the economic failures of weaker competitors. The survivors will benefit from the operational efficiencies that the market forced them to create, better profit margins and a better work force. The key to maintaining your surety's support is communication that enables them to make a comprehensive business decision as a partner, instead of an underwriting decision as a creditor.

Construction Business Owner, February 2010