With Section 179 in effect for the remainder of 2016 and onward, there has never been a better time to invest in new construction and office equipment for your organization. With recent improvements approved by Congress, Section 179 of the Internal Revenue Code now allows organizations to completely deduct the purchase cost of equipment, up to a specific amount, the first year it is put into service. Basically, Section 179 allows businesses to deduct the full price of qualifying equipment purchased or financed during the tax year. It is an incentive created by the United States government to encourage businesses to stimulate the economy. Section 179 is designed to make purchasing equipment during a calendar year financially feasible and affordable. The Section 179 expense deduction is elected by completing Form 4562. Instructions for completing Form 4562 are on the IRS website. Section 179 comes with many benefits for business owners, but specific criteria must be met.

Only depreciable, movable property qualifies for this tax incentive. As an alternative to depreciating capital purchases over time, Section 179 of the IRS tax code allows businesses to deduct from taxable income all or part of the purchase price of new and used equipment and software in the year the items were acquired.

Gain Some Perspective

It is fairly easy to qualify for the Section 179 Deduction. All that is required is that the equipment must be purchased and placed into service between January 1 and December 31 of the tax year in which you are claiming the deduction. For example, purchases or capital leases of qualifying equipment made in 2016 will allow you to deduct the full purchase price from your gross income on your 2016 tax return. The new limit for the Section 179 deduction in 2016 is $500,000, which applies to both new and used equipment purchases.

This means that for qualifying equipment purchases of up to $500,000, your company can deduct 100 percent of the purchase price from its taxes the very first year it is put into service. However, there is a spending cap of $2,000,000. Businesses with more than $2,000,000 in equipment purchases will have the expense deduction phased out dollar for dollar up to $2,500,000.

Bonus depreciation may also be available for businesses that exceed the $500,000 maximum Section 179 deduction. Bonus depreciation was extended through 2019, and in 2016 businesses can deduct 50 percent of the cost of the equipment acquired and put into service before December 31. Bonus depreciation will phase down to 40 percent in 2018, and 30 percent in 2019. It is important to note that while the Section 179 deduction applies to new and used equipment, bonus depreciation is only available for new equipment.

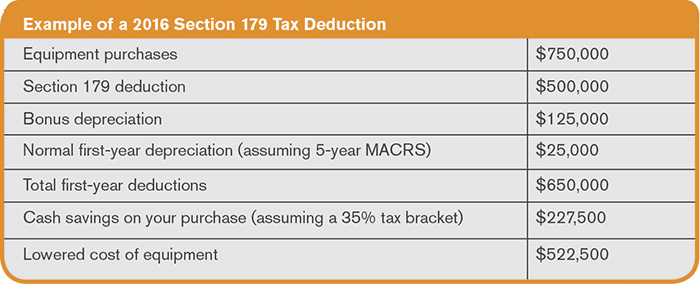

Standard depreciation deductions also apply. This is generally determined by the useful life of the equipment. In the example below, assume depreciation is over a 5-year period. Refer to Figure 1 on page 39 for a better understanding of how this can help owners of heavy-duty construction and mining equipment. Section 179 can be a very beneficial incentive for businesses that plan to purchase equipment in 2016 and can ultimately lower the true cost of the equipment.

Financing & Fleet Management Considerations

It is important to understand that Section 179 can be used in multiple purchases of equipment or other items. Section 179 expense deductions can be distributed among the equipment or other purchases in any way. The Section 179 deduction is limited to business taxable income generated in the year the deduction is taken. Any excess can be carried over to future years. Businesses may also elect to carry over, for an unlimited number of years, any remaining amount they choose. This provides businesses with a flexible tax planning tool, allowing them to postpone deductions to future years. In fact, some companies will find it more beneficial to use only a portion of the deduction allowed under Section 179. This may reduce the marginal tax rate in the current year, while retaining some tax basis in the property to depreciate in future years. Companies who deduct only part of the cost of qualifying property as a Section 179 expense deduction can generally depreciate the cost not deducted.

It is also important to consider the interest-earning potential of money when deciding whether to use the Section 179 deduction. Nearly all organizations have a positive time predilection for money, meaning that earnings received today are preferred to the same amount earned at some future date, all else equal.

Making sound investment decisions requires using more than just tax criteria alone. Capital purchases should be considered in regard to whether they advance the firm’s financial goals and objectives, and not solely on whether they minimize taxes. Caution should be taken with an investment that provides short-term tax benefits that could negatively impact a firm’s profitability, solvency or long-term liquidity. Finally, the size of your organization can also be a deciding factor in how you want to apply Section 179. Smaller companies that are in a relatively low tax bracket now, but anticipate being placed in a higher bracket in the near future, may find it beneficial to save a portion of the deduction for future years. Larger companies that have been pushed into higher tax brackets in recent years might want to consider using Section 179 deductions up to the business income limits.

Figure 1

Figure 1Exclusions of Section 179

One of the exclusions of Section 179 is that it does not give a tax credit for property acquired through gift or inheritance. Additionally, property purchased from certain related parties, including control groups and relatives, is not considered acquired by purchase, so Section 179 cannot be used for that particular piece of property. Business owners may elect the Section 179 expense deduction instead of recovering the cost by taking annual depreciation deductions. Business owners must also be careful about the use of the equipment they purchase. If the business use of the product drops to 50 percent or less in any year during the property’s recovery period, the Section 179 expense deduction may be reversed by the IRS. Consult your accountant or tax professional before you utilize section 179 for tax savings.