Research by Dodge Data & Analytics (Dodge) shows that 33% of typical construction projects come in over budget. Ask yourself:

How well does my company manage construction costs? How do my capabilities compare to other construction companies? How unique are my cost management challenges? What are other contractors doing to address their challenges and what is proving most effective for them? What would most improve cost management capabilities for everyone?Though cost management is extremely important, it can be hard to answer these questions because so little research has been done about these challenges and their solutions.

To help fill this gap, Dodge recently published the Construction Cost Management Report. Based on a survey of more than 700 contractors and owners in North America, U.K. and Australia, the report, underwritten by Procore, specifically addresses:

Current capability levels Top challenges Use of and satisfaction with technology solutions Most important success metrics Investment in cost management Greatest needs for future improvementDetermining Cost Management Capability Levels

To baseline cost management capabilities, survey respondents rated how well each of the ideal outcomes shown below applies to their company.

I can accurately assess risk related to any changes, billing or performance issues. I can dynamically track every dollar in my budget and forecast critical costs with real-time data from the field, while staying in sync with the accounting system. I can easily uncover cost details and create comprehensive financial reports from a single source of truth. I can leverage data from previous projects to benchmark cost performance and improve future estimates. I can manage collaborative workflows and centralize communication across our office, field, clients/contractors and/or vendors to reduce project and payment delays. I know where we are making or losing money on a project, or across my portfolio, at any given moment. My company’s change-management process is streamlined from start to finish. My company’s cost-management capabilities create a competitive advantage for us.The findings reveal that:

Determining the Industry’s Top Cost Management Challenges

From a list of 15 challenges, each respondent selected the five most applicable to their company. The top 10 ranked across all the contractors are:

Tracking costs for every aspect of the job to determine how they impact overall project cost. Accurately estimating total cost to complete for activities in the work breakdown structure. Tracking units of work completed in the field. Converting a final cost estimate into a project budget compatible with cost accounts. Status reporting during the project. Determining appropriate contingency amounts. Assessing risk related to potential changes. Understanding in real-time where we are making or losing money. Control of project cash flows. Establishing a system of cost accounts.These other five challenges listed below were included among their top five by an average of 19%, so are not insignificant: Maintaining accurate, up-to-date cost information between office and field; managing multiple contracts and/or purchase orders; managing change orders and documentation through the whole approval process; effectively integrating cost and schedule information; and understanding in real-time which areas of the project need more attention.

While company size doesn’t influence results, there is also little variation between specialty trades and general contractors, suggesting a commonality in the underlying challenges facing all construction cost managers.

Use & Satisfaction With Cost Management Solutions

Each respondent was shown the top five challenges he/she had selected and asked a series of questions about how they are being addressed. Technology-related results include the following.

Number of Technology Tools Used to Address Top Challenges

Contractor findings vary widely, with some exclusively using a single cost management tool while others are using five or more. Trends include:

About two-thirds (65%) are either using a single technology tool companywide (21%), or at least have a primary one even if others are sometimes used (44%). Among the contractors with high-cost management capabilities, about three-quarters (range of 70-84% depending on the challenge) use a single tool for their top challenges, suggesting a benefit to limiting the number of tools used. A similar preference for using a single tool is expressed by individuals with project-focused roles compared with those in office-related positions, perhaps reflecting better ease-of-use in the field.Types of Technology Tools Used to Address Top Challenges

About half (48%) report primarily using commercially available purpose-built cost management tools, either desktop (30%) or cloud-based (18%).

The others still primarily rely on either an internally developed tool (32%), spreadsheets (16%) or manual processes (4%). Trends include:

Above-average percentages of the high-capability contractors are using commercial tools for their top challenges. In the U.S., commercial tools show highest use for two of the top 10 challenges: No. 3: Tracking units of work completed in the field (59%) No. 8: Understanding in real time where we are making or losing money (68%).Satisfaction with Technology Tools to Address Top Challenges

Trends include:

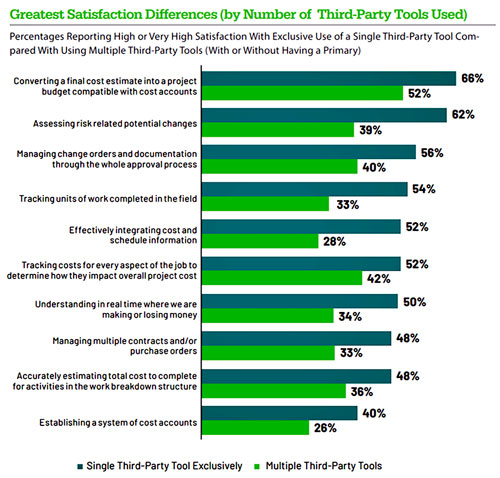

Across users of all types of tools, only 39% of contractors express high or very high satisfaction with how well they address top cost management challenges. Overall, general contractors express higher satisfaction than specialty trades. Contractors using third-party commercial tools report higher satisfaction than the others. Among users of commercial tools, the data shows that companies using a single tool are more satisfied with their processes. The greatest differences are shown in the chart, again suggesting that companies may benefit from focusing on fewer, more comprehensive tools.Cost Management Metrics

The data revealed several trends among the ten metrics to measure cost management success studied.

Investment Levels

Cost management requires investments of staff time, training and technology.

Respondents were asked if they believe their company is investing adequately.

While 39% believe they are spending more than they should, only 14% feel it is much more. Almost 30% believe they are not spending enough.Highest Needs for Future Improvement

From 14 possibilities, respondents selected the most critical cost management processes and outcomes their companies need to improve over the next three to five years.

Comparing Contractors’ and Owners’ Needs

One goal of the report is to help owners and contractors understand each other’s priorities so that cost management can be more effectively focused on improving outcomes for everyone. The findings reveal that both agree the two most-needed improvements are:

Forecasting critical costs with real-time data from the field Dynamically tracking every dollar in a budgetBut their priorities diverge somewhat for their next five, as shown in the table to the right.

This analysis is intended to shed light on these opportunities for better mutual alignment so that all parties can benefit from improved cost management.

Final Thoughts

Key takeaways from this research:

There is a lot of room to improve cost management capabilities in the construction industry. Users prefer using fewer technology tools and express a preference for third-party solutions over internally developed or adapted generic ones to address their most significant challenges. The variations identified between the most important future needs of contractors and owners highlights the opportunity to adopt a new integrated team-wide approach to cost management that will improve outcomes for all parties.