Generating positive cash flow is imperative. Many contractors evolve from technical backgrounds—building construction, engineering or the trades—and may not start their businesses wired to think like a businessperson. Blindly submitting an invoice and forgetting about it until next month is hardly a best practice. Every firm must define its payment procedures regardless of outlying circumstances.

Ask For It

Consider the customer/employee exchange at a restaurant. Assuming the meal was satisfactory, the wait staff will approach the customer at the end of the meal with a bill—the customer is not outraged. In addition, the patron would not wait 30 to 45 days to pay the bill, and would not hold a portion back to protect against unforeseen conditions, such as food poisoning or high cholesterol.

Contractors play this game every day, though. In some cases, they are afraid to ask for their money. Assuming a contractor acts within their rights, has followed the contract documents and does the asking in a polite manner, why would someone resent an invoice? Often, these negative feelings are derived from two sources: 1) It is awkward to ask someone for money and 2) Asking for payment assumes that every step in the process has been followed correctly. Before the process is addressed, get over the hurdle of asking for compensation.

Follow the Process

There should be a process for everything within a firm, especially for something as important as getting paid. Because every customer is different, contractors leave the payment process to the discretion of the manager. Below is a brief summary of the steps contractors should follow as part of their process.

- A pencil and paper copy of the invoice is proposed to the customer for review

- A hard copy of the invoice is provided with the applicable documents as dictated by the contract

- The invoice is hand-delivered to the customer (where applicable)

- A phone call is placed to the accounting department of the customer to ensure the invoice was received

- A phone call is placed to the accounting department to ensure the invoice is still in the system

- A phone call is placed to the accounting department to ensure the invoice is slated to be paid (assumes payment on the 30th or end of the month)

- A phone call is placed to the accounting department to provide a routing number or transportation vehicle (courier) to the customer for distribution

It is important to note that not all payment cycles are equal. Consider the contract terms. How often does a contractor complain about payment only to examine the contract, subcontract or purchase order and realize payment terms are Net 60 or "paid when paid?" Ignorance of a contract that you or your management team signed is not an acceptable rationalization to harass a customer for being a weak payer. Secondly, the subsequent phone calls are not meant to resemble that of a strong-armed debt collector. These calls are friendly reminders that will hopefully get a contractor's invoice to the top of the pile.

It should be noted that the project manager is making the calls in the aforementioned process; so many contractors view this as the accountant's job. Generating the invoice might be accounting's job, but following up and ensuring timely payment is the role of the manager.

Measure Metrics and Escalation

It is imperative that everyone understands how well the firm is doing collecting its money. Firms that provide regular feedback to the management team on collections are more likely to be proactive collectors. For instance, review the collections and outstanding invoices during a weekly or monthly operations meeting.

Additionally, there are plenty of clients that need a gentle prod. If the project manager has followed the system and the contract documents, determine an effective escalation strategy. Creating a sense of awareness among a firm's customer base is important. The only way to do that is to demonstrate how important cash flow is to your firm. Letting invoices ride week after week only demonstrates a lack of importance and further reinforces a customer's unwillingness to pay promptly.

Table 1

Table 1Be Creative and Selective

Consider creative terms that will allow quicker and more expeditious payment. For instance, during the estimating phase, perhaps consider providing an alternate for discounting; assuming payment is made within 15 days of the invoice. Additionally, what sort of discount could be offered if bimonthly invoicing is offered? Examine your own accounts payable. How many of those invoices have different payment terms?

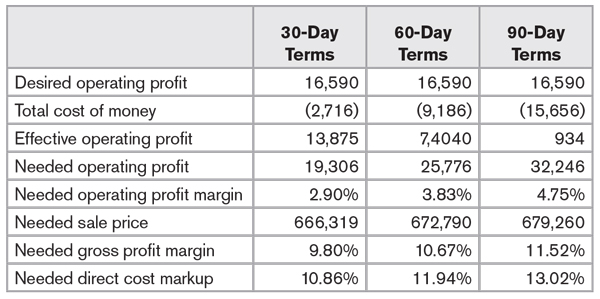

Lastly, be selective. Customers that are historically weak should be examined regularly. Most contractors do not have a line item in their estimates called "interest carry." However, as accounts receivables age, there is a cost associated with financing. Table 1 illustrates the cost of money and the effect it has on profitability through 30-, 60- and 90-day terms.

As firms examine their competitiveness and balance an effective profit margin, it would be reckless to discount the effect of the time value of money. Compound this over 15 or 20 projects within a firm and the cost can be staggering. Understand the cost of certain customers and make rational business decisions.

The true leaders in the construction business are those who understand cash flow and make it a priority in all of their processes.